News

Impact investing: a shot in the arm for African healthcare

September 3, 2019

In an ideal world, people would be able to access the healthcare they need without suffering financial hardship. That’s essentially what the World Health Organisation means when it, and the global bodies it works with, talk about universal health coverage (UHC).

The United Nations’ Sustainable Development Goals (SDGs) contain clear targets for achievement of UHC by 2030, among a long list of global development milestones. In Africa, unfortunately, progress towards achieving UHC is beset by significant barriers, including lack of financial resources, inadequate human and physical infrastructure and limited human resource capacity.

Inadequate public sector response

National governments bear the responsibility for the healthcare of their populations, but their spending is all too often hampered by other significant challenges. In the 2001 Abuja Declaration, African governments admirably pledged 15% of their annual budgets on healthcare by 2015; however, due to competing priorities, few countries achieved that target.

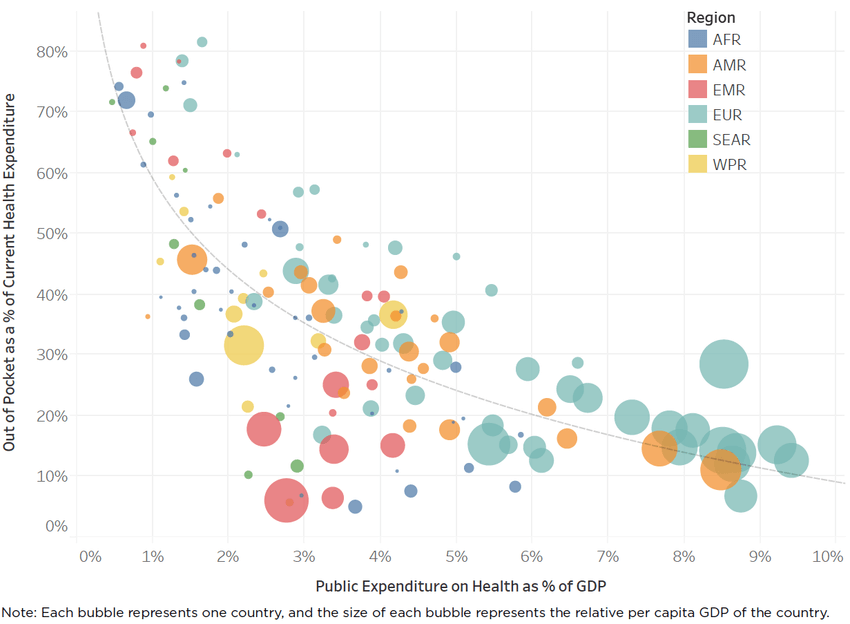

As a result of these challenges, there is increasing recognition that public-sector spending alone is inadequate to achieve UHC; complementary private sector investment and involvement is necessary. Indeed, the need for private sector involvement in global development in general is embodied in SDG 17, Partnerships for the Goals.

Image: WHO

As a tool to attract private-sector engagement, impact investing represents a tremendous opportunity to make UHC a reality in Africa. Impact investing combines social impact and the expectation of financial returns in a way that is mutually reinforcing; “doing good” just as much as traditional philanthropy, but with added financial benefits for investors, implementers and recipients.

The impact investing market is currently estimated at $502 billion, and is growing at a rapid pace as socially minded investors, family offices, investment funds and other companies recognize the power of this approach. It is growing in sectors such as energy, banking, education, housing and infrastructure, with returns that rival non-impact investment portfolios. Naturally, as the market grows, significant players from banking, insurance and healthcare – including MSD – and other industries are joining in, fuelling a cycle of more growth and better expertise in the sectors invested in.

Impact investment’s health boost

For healthcare specifically, impact investments can target various complementary facets of the health ecosystem, including physical infrastructure, financial solutions, emergency response, and drug, vaccine and diagnostic development. Direct investments into individual companies allow for targeted opportunities; fund investments enable portfolio diversification to balance risk and return. A few examples can help illustrate the growing landscape:

• To expand and enhance the physical infrastructure of hospitals and clinics that serve lower-income patients, Evercare is building networks of health facilities in high-growth markets in Africa and Asia.

• UNICEF’s Bridge Fund is an accelerator for the provision of healthcare commodities that offers investors a reliable fixed rate of return while deploying critical supplies for relief and development globally.

• The Global Health Investment Fund (GHIF) has a robust portfolio of companies focused on the development of pharmaceuticals, vaccines and diagnostics to address infectious diseases in Africa and other parts of the developing world.

• TEAMFund is prioritizing non-communicable diseases (NCD) through investments in digital tools and diagnostics in emerging markets that include sub-Saharan Africa.

• Kinect is developing blockchain technology to engage patients and improve health outcomes in the developing world, with an explicit focus on supporting the SDGs.

Upping the impact by 2030

Through health initiatives backed by impact investing, patients are being served, markets are thriving, and public sector national health objectives are reinforced. As a result, sustainable progress is being made towards UHC. What else can the impact investing community and supporting stakeholders do to bring it to fruition in Africa?

For one, more investment vehicles focused on health are needed. Companies and funds like the ones listed above, built on debt and equity models, can broaden the landscape for sustainable health impact. Results-based financing solutions can be expanded, such as through development impact bonds, to directly link investment returns to program outcomes. And groups such as the Global Impact Investing Network (GIIN) and the Africa Impact Investing Leaders Forum are helping to energize the community of investors, practitioners and policymakers so that the impact investing space can thrive and grow.

A hands-on approach to fostering innovation helps, too: Halcyon’s Incubator employs a unique model to support founders and their start-up companies through the intensive support and guidance needed to test and scale business models that seek social impact. For instance, Halcyon is working with Kaaro Health to advance their efforts to reach underserved populations in rural Uganda though a high-tech “clinic in a box” system that links patients with healthcare providers.

Originally an endeavour of smaller or less-well-known financial institutions, impacting investing is going mainstream. This is a positive trend, and large, global financial institutions can continue to develop mechanisms to engage in the field – directly, and as a conduit for their personal and institutional clients – to grow the scope and scale of healthcare-related impact investing.

Greater alignment between public and private UHC efforts will sharpen the impact and returns – social and financial – of investments, identifying gaps and mobilizing partners. A hybrid approach will have the most impact.

Finally, continued evolution and integration of measurement frameworks can help set objectives, align efforts and report outcomes consistently across platforms.

UHC, long an elusive goal, will require contributions from a wide range of stakeholders. Impact investing offers a promising, sustainable approach to catalyze the necessary resources and to accelerate progress towards better health across the continent.